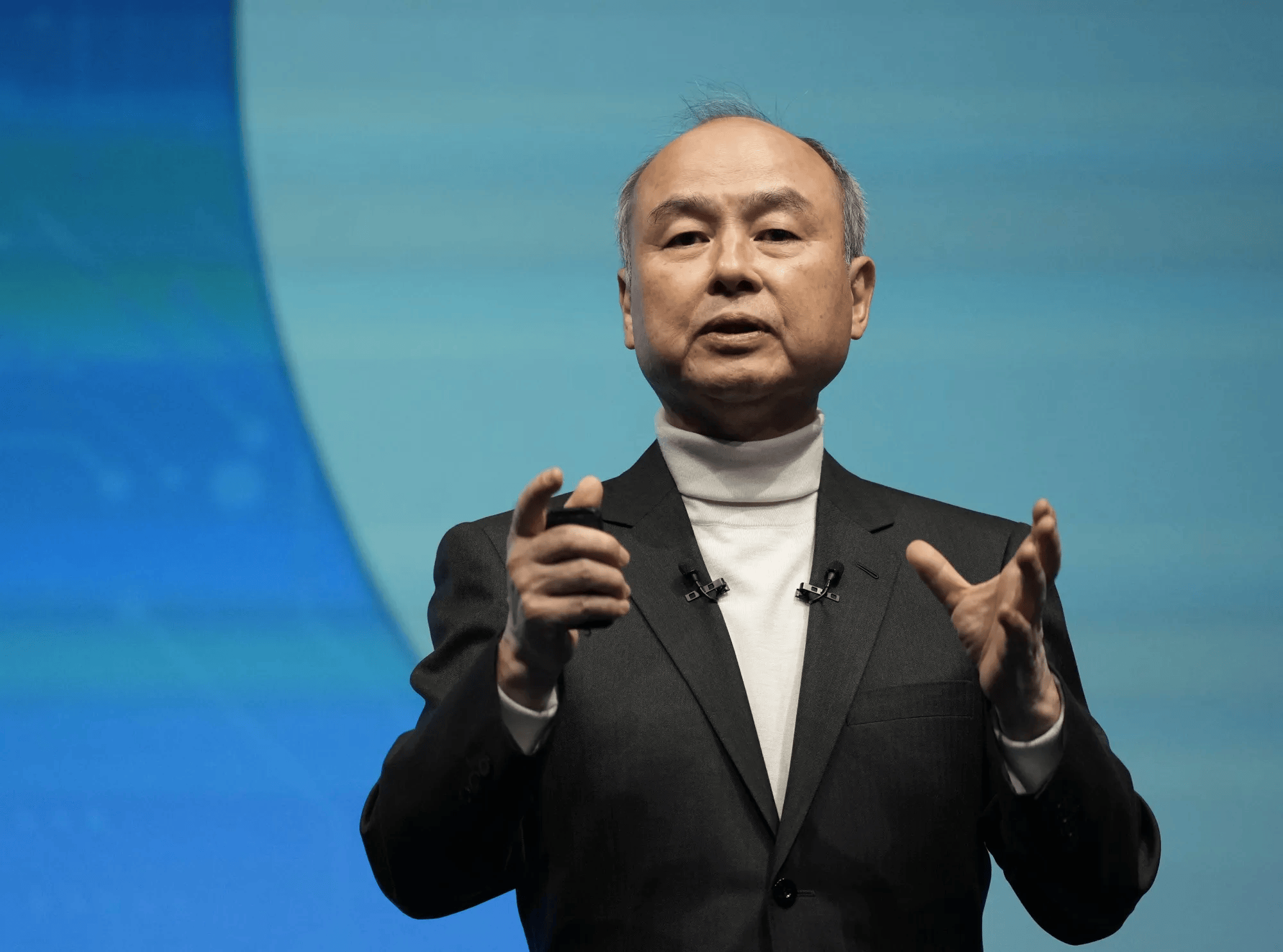

Masayoshi Son, Founder, Chairman, and CEO of SoftBank Group

AsianFin -- SoftBank Group has finalized a $6.5 billion all-cash deal to acquire Ampere Computing LLC, a semiconductor designer specializing in data center processors.

The acquisition underscores SoftBank's new focus on artificial intelligence (AI) infrastructure and its efforts to capitalize on the booming demand for advanced computing solutions.

The agreement, confirmed in a joint statement on Wednesday, values Santa Clara-based Ampere at $6.5 billion. Early investors in Ampere, including Oracle Corp. and private equity firm Carlyle Group Inc., will sell their stakes as part of the transaction, which is expected to close in the second half of 2025. Ampere will operate as a wholly owned subsidiary of SoftBank, retaining its name and headquarters.

Ampere, founded by former Intel executive Renee James, designs processors for data center equipment using technology from Arm Holdings Plc, a chip designer majority-owned by SoftBank. The company has positioned itself as a key player in the data center chip market, emphasizing energy efficiency—a critical factor as the resource demands of large data centers continue to grow.

"With a shared vision of advancing AI, we are excited to join SoftBank Group and partner with its portfolio of leading technology companies," said James, Ampere's CEO, in a statement. "This is a fantastic outcome for our team, and we are excited to drive forward our AmpereOne roadmap for high-performance Arm processors and AI."

The acquisition comes amid a surge in demand for advanced chips, driven by the rapid expansion of AI infrastructure. By acquiring Ampere, SoftBank gains access to one of the few independent design teams specializing in data center chips, enhancing its ability to compete in the increasingly competitive semiconductor market.

Ampere is part of a wave of companies that have sought to leverage Arm's mobile-optimized technology to carve out a niche in the lucrative data center chip sector. While many of these efforts have faltered or been absorbed by larger firms, Ampere's acquisition by SoftBank keeps this strategy alive. The company has emphasized the power efficiency of its chips, a significant advantage as data centers face growing challenges related to energy consumption and operational costs.

For SoftBank, the deal represents an opportunity to strengthen its position in the AI and semiconductor markets. The investment firm has been actively seeking ways to capture a larger share of the AI infrastructure spending boom, and Ampere's expertise in high-performance computing aligns with this goal.

"The future of artificial superintelligence (ASI) demands unprecedented computing power," said SoftBank Chairman and CEO Masayoshi Son in a statement. "Ampere's expertise in semiconductors and high-performance computing will help accelerate this vision and deepen our commitment to AI innovation in the U.S."

ASI is a hypothetical software-based AI system with intellect beyond human intelligence.

The acquisition also aligns with Arm's broader strategy to transition from providing foundational technology to offering more comprehensive solutions that command higher prices. By integrating Ampere into its portfolio, SoftBank aims to leverage the company's resources and customer base to enhance the economics of chip design and development.

Son once lamented missing out on a $200 billion stock appreciation opportunity with Nvidia. In 2017, during a low point in Nvidia's stock price, SoftBank acquired nearly 5% of the company's stake for just $700 million, becoming its largest shareholder.

However, just two years later, SoftBank sold off its entire stake for $3.3 billion—a decision that proved costly as it occurred just before the AI boom sent Nvidia's valuation soaring to $3 trillion.

"You may not know this, but Masayoshi Son was once Nvidia's largest shareholder," Nvidia CEO Jensen Huang said during a recent event. "He is a one-of-a-kind entrepreneur and innovator with an extraordinary ability to identify the winners of each era and collaborate with them. He brought Bill Gates and Jerry Yang to the Japanese market, helped Alibaba introduce cloud computing to China, and brought Steve Jobs and the iPhone to Japan." (please check the quote)

At that moment, Son appeared visibly awkward, with his face showing a mix of regret and amusement. He responded by hugging Huang tightly, pretending to cry. Huang, laughing, hugged him back and quipped, "Let's cry together." Later, Huang couldn't resist teasing Son again, asking, "Can you imagine if you were still Nvidia's largest shareholder today?"

Huang also revealed that a decade ago, Son had offered to help privatize Nvidia by providing funding, but Huang declined the proposal. Reflecting on the decision, Huang joked, "Now I regret it."

Son's regret over the Nvidia sale is well-documented. At SoftBank's shareholder meeting in July 2023, he openly chastised himself, saying, "Every time I think about these missed opportunities, it's truly frustrating. I almost sold Nvidia's stock with tears in my eyes, missing out on such a massive gain."

Now, with the $6.5 billion acquisition of Ampere Computing, a high-performance AI chip designer, and investments in OpenAI and Arm, Masayoshi Son is positioning SoftBank for a strong comeback in the AI era.

Son has made bold predictions about the future of artificial superintelligence (ASI), stating that it will be 10,000 times smarter than the human brain and will emerge by 2035. However, building such a system will require at least 400GW of electricity, 200 million chips, and $9 trillion in funding—a figure he believes might even be an underestimate.

免责声明:本网信息来自于互联网,目的在于传递更多信息,并不代表本网赞同其观点。其内容真实性、完整性不作任何保证或承诺。由用户投稿,经过编辑审核收录,不代表头部财经观点和立场。

证券投资市场有风险,投资需谨慎!请勿添加文章的手机号码、公众号等信息,谨防上当受骗!如若本网有任何内容侵犯您的权益,请及时联系我们。

相关文章

-

做最有烟火气的AI!老板电器发布新一代食神大模型

2025-03-218阅读

-

触底反弹!孤独者李彦宏,与百度的伟大崛起

2025-03-218阅读

-

3月LPR降息落空 二季度窗口打开

2025-03-218阅读

-

百度老板李彦宏愁坏了,公司竟藏卧龙凤雏!

2025-03-218阅读

-

卫星互联网发展步入快车道 智能化运维成降本“利器”

2025-03-218阅读

-

英伟达马斯克xAI加入微软贝莱德财团,投资美AI基础建设

2025-03-218阅读

-

腾讯的AI新主张:拥抱开源、增加资本支出,扩大业务应用朋友圈

2025-03-218阅读

-

华为汪涛:2025年将成为AI智能体元年

2025-03-218阅读

-

做最有烟火气的AI,老板电器发布新一代食神大模型

2025-03-218阅读

-

腾讯AI布局全力加速,能否成为新增长极?

2025-03-218阅读